|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How to Refinance Your Home: A Comprehensive GuideRefinancing your home can be a smart financial move, but it's important to understand the process and determine if it's the right decision for you. This guide will walk you through the essential steps and considerations. Understanding Home RefinancingRefinancing involves replacing your existing mortgage with a new one, often with different terms. Homeowners refinance to lower interest rates, change loan terms, or access home equity. Benefits of Refinancing

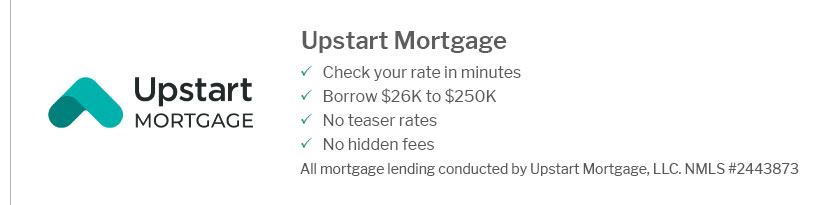

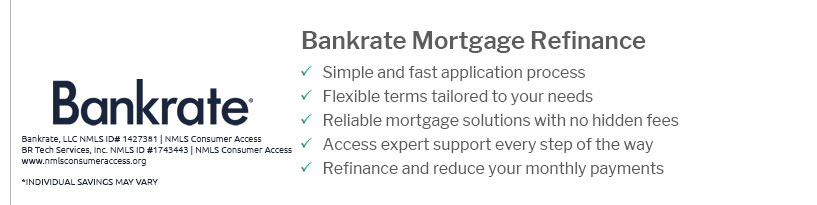

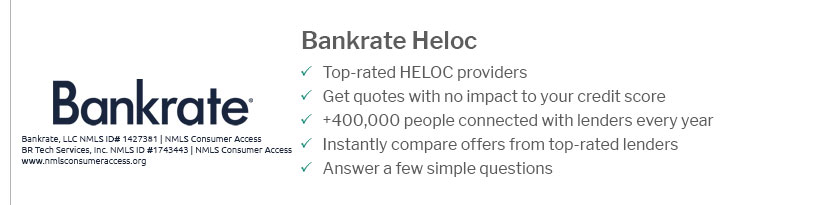

Steps to Refinance Your HomeEvaluate Your Financial GoalsBefore proceeding, assess your reasons for refinancing. Ask yourself, should we refinance our mortgage to achieve lower payments or to tap into equity? Check Your Credit ScoreA higher credit score can secure better terms. Review your credit report and address any discrepancies. Gather Necessary DocumentationPrepare your financial documents, including tax returns, pay stubs, and bank statements. Shop for LendersCompare rates and terms from various lenders to find the best deal. You can start by visiting apply for mortgage loan for competitive offers. Apply for the LoanSubmit your application along with the required documentation. Be prepared for a home appraisal and underwriting process. Frequently Asked QuestionsWhat are the costs associated with refinancing?Refinancing costs typically include application fees, appraisal fees, title insurance, and closing costs. It's crucial to weigh these costs against potential savings. How long does the refinancing process take?The refinancing process can take anywhere from 30 to 45 days, depending on various factors including lender efficiency and your preparedness with documentation. Can I refinance with bad credit?While challenging, it's possible to refinance with bad credit by exploring options such as FHA loans or finding a cosigner. However, be prepared for potentially higher interest rates. Refinancing your home is a significant decision that requires careful consideration and planning. By understanding the process and evaluating your financial goals, you can make an informed choice that benefits your financial future. https://myhome.freddiemac.com/refinancing/options-for-refinancing

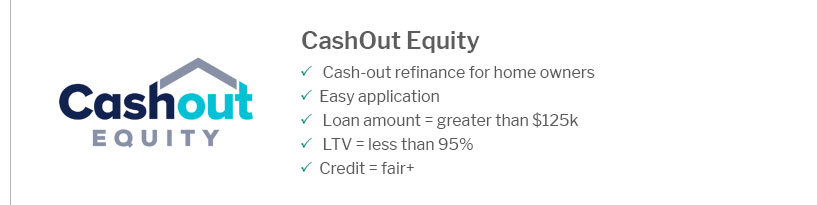

If you are considering refinancing your mortgage, there are two primary options you'll need to choose between: no cash-out refinance and cash-out refinance. https://www.reddit.com/r/FirstTimeHomeBuyer/comments/11voyy0/how_to_refinance_home/

Refinancing is just like financing in the first place. You are trying to get a new mortgage on your property for one reason or the other. In the ... https://www.lendingtree.com/home/refinance/how-to-refinance-a-mortgage/

A mortgage refinance involves more than just replacing your mortgage and paying it off with a new loan to get a lower interest rate.

|

|---|